philadelphia wage tax for non residents

For non-residents the Wage Tax applies to compensation for work or services performed in the City and for work performed outside of the City for personal reasons. The wage tax rate is set to drop from 384 to 379 for city workers and the median annual household income for Philadelphia is about 49k.

File Philadelphia Wage Tax Return Quarterly In 2022 Wouch Maloney Cpas Business Advisors

This tax does not apply to nonresidents.

. All Philadelphia residents owe the City Wage Tax regardless of where they work. The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate of 35019 percent 035019. Ad PA Employee Earnings Tax More Fillable Forms Register and Subscribe Now.

A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization. Kenney had proposed reducing the tax for city residents to 37. This change must be in place for all.

344 0344 The non-resident City Wage Tax applies to those employed by a Philadelphia-based entity. Therefore the wages of employees who are working remotely outside the City of Philadelphia are not applicable to City Wage Tax. Wage Tax for Residents of Philadelphia.

Non-resident employees who work for Philadelphia-based employers are not subject to Philadelphia Wage Tax during the time they are required to work outside of Philadelphia. Philadelphia imposes a Wage Tax on all salaries wages commissions and other compensation received by an individual for services. The City of Philadelphia announced yesterday that there will be a wage tax rate increase for non-residents starting July 1 2020.

For information concerning the requirements for withholding of the Earnings Tax in connection with COVID-19 see EY Tax Alert 2021-0957. Schedules to withhold and remit the tax to the City remain the. The Philadelphia Department of Revenue has not changed its Wage Tax policy during the COVID-19 pandemic.

The current wage tax rate in the city is 34481 percent. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. Effective April 1 2020 for employees paid monthly and March 28 2020 for employees paid biweekly the Philadelphia Non-Resident Wage Tax payroll deduction will be turned off for the applicable employee population.

Effective July 1 2021 the rate for residents is 38398 percent and the rate for non-residents is 34481 percent. Effective July 1 2022 the Philadelphia City Wage Tax will decrease for both residents and non-residents. The new wage tax rate for non-residents who are subject to the Philadelphia City Wage Tax is 35019.

The City Wage Tax for Philadelphia residents is 38712 and 35019 for non-residents. The Philadelphia School Income Tax SIT which applies to residents who receive certain types of unearned income is 38398 for tax year 2021. Non-residents who work in Philadelphia are also subject to City Wage Tax but at the lower rate of 35019.

Non-residents who work in the city will see their wage tax rate decline from 3448 to 344 under the approved budget. The Wage Tax rate for residents of Philadelphia will remain the same at 38712. All Philadelphia residents regardless of where they work are subject to Wage Tax at the rate of 38712.

With that household income youd pay 1886 per year. Non-residents who work in Philadelphia must also pay the City Wage Tax. 379 0379 Wage Tax for Non-residents of Philadelphia.

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Approval Of Business And Wage Tax Cuts Hailed As Turning Point By Philadelphia Business Leaders Philadelphia Business Journal

Over 42 000 Philadelphians Use New Online Tax System On Top Of Philly News

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Tax Breaks As Property Values Surge Tourism Makes A Return Septa Starts Cleanup Blitz Sunday Roundup On Top Of Philly News

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Wealth Tax Proposed In Philadelphia With Support From Sen Elizabeth Warren Philadelphia Business Journal

Who Pays Wage Tax And When Department Of Revenue City Of Philadelphia

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia

Philly City Council Reaches Budget Deal With Tax Relief Whyy

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

Philly Budget Wage Tax Shrinks Anti Violence Spending Up Whyy

Philly Announces New Tax Rates For Wage Earnings And Other Taxes Department Of Revenue City Of Philadelphia

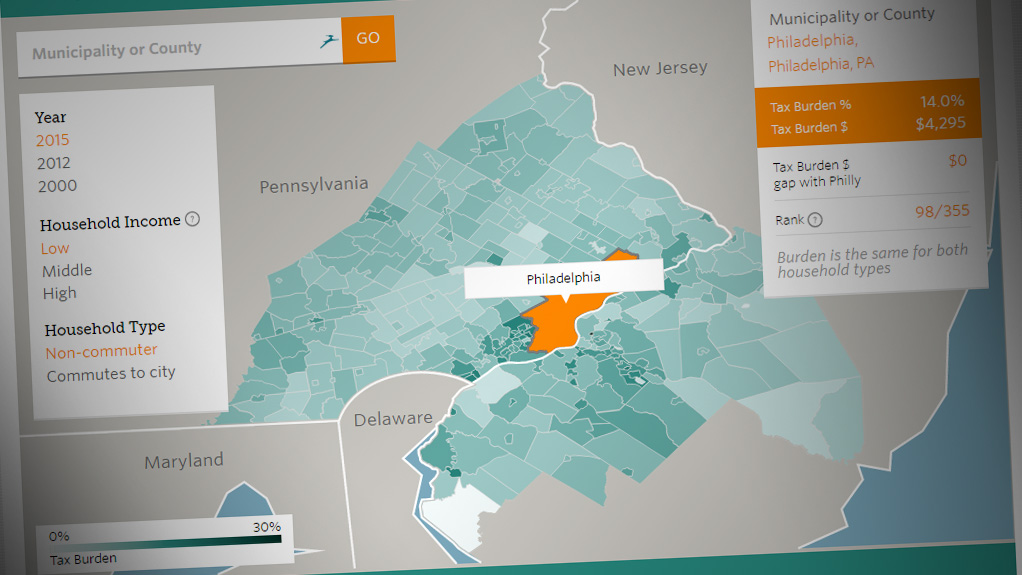

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

Philadelphia Wage Tax Cut What Does It Mean For Workers On Top Of Philly News

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Philadelphia City Council Approves Business Wage Tax Cuts In 5 6b Budget Deal Nbc10 Philadelphia